Which of These Annuities Require Premium Payments

But like any other choice you make with your money annuities have both pros and cons. This could be a large deposit from your savings or a transfer from a.

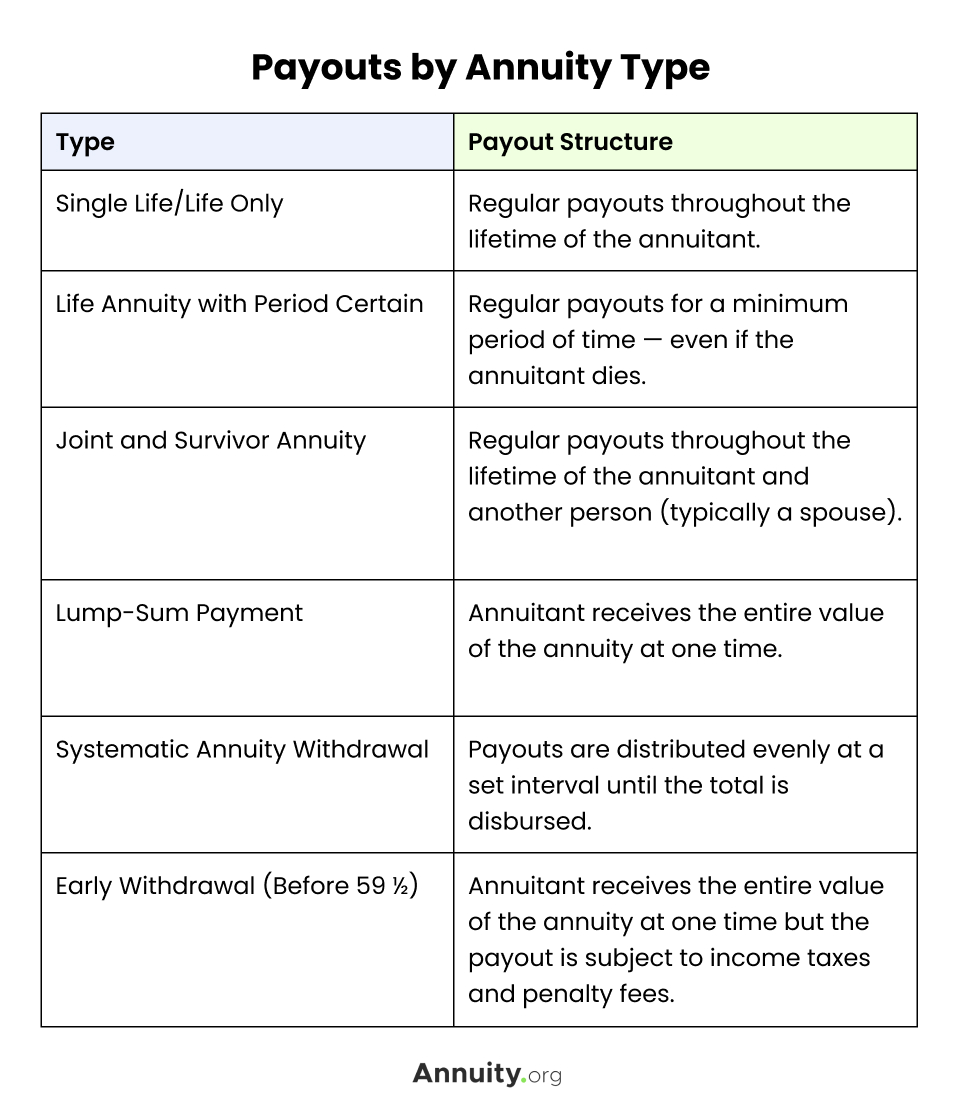

Annuity Payout Options Immediate Vs Deferred Annuities

The annuity is not guaranteed by any bank or credit union and is not insured by the FDIC or any other governmental agency.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

. Accessing cash value will reduce your policy death benefit and values may result in certain fees and charges and may require additional premium payments to maintain coverage. First it may be helpful to have a precise definition of an annuity in mind. This option guarantees that if the annuitant or both annuitants for a Joint Life policy dies before the income payments received equal the premium paid the beneficiaryies will receive a lump sum equaling the premium minus income payments received.

With fixed annuities payments are guaranteed to be the same amount each month. These funds may also be liable to estate taxes depending on who the beneficiary is. For most variable annuities beneficiaries receive at least the original amount the owner contributed.

Income payments guaranteed for one life or two lives for a Joint Life policy. It is designed using a mortality table and mainly guaranteed by a life insurerThere are many different varieties of annuities sold by carriersIn a typical scenario an investor usually the annuitant will make a single cash premium to own an annuity. Single-Premium Deferred Annuities With a single-premium deferred annuity you pay for the contract with one lump sum payment.

Both immediate and deferred annuities can be either fixed or variable. For example a fixed-period annuity also called a period-certain annuity guarantees payments to the annuitant for a set length of time such as 10 15 or. For some immediate annuities such as a lifetime immediate income annuity without term certain the insurance company keeps the money when the owner dies.

Knowing what they are can help you make an informed choice about whether an annuity fits your life and plans. In most cases annuities that are variable are not Medicaid compliant. A SPIA is a contract between you and an insurance company designed for income purposes only.

The purchase of an annuity is not a provision or condition of any bank or credit union activity. For fixed annuities the beneficiary receives the present value of payments. Ask your financial professional for details on accessing your cash value including how it might impact the coverage guarantees and situations when the values you access.

In the United States an annuity is a structured product that each state approves and regulates. Some annuities may go down in value. After the policy is issued the.

One of the most common ways to think about an annuity is to think of it as a type of insurance product that provides a guaranteed income stream. Annuities promise to provide a stream of income that lasts for your entire life the option of deferring taxes and other helpful features. Unlike a deferred annuity an immediate annuity skips the accumulation phase and begins paying out income either immediately or within a year after you have purchased it with a single lump-sum paymentSPIAs are also called immediate payment annuities income annuities and immediate.

Annuities are intended as long-term savings vehicles. With variable annuities payments vary based on how well the investments of the annuity do.

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities1-0cea56f3b4514e44bed8f45d9c74011e.png)

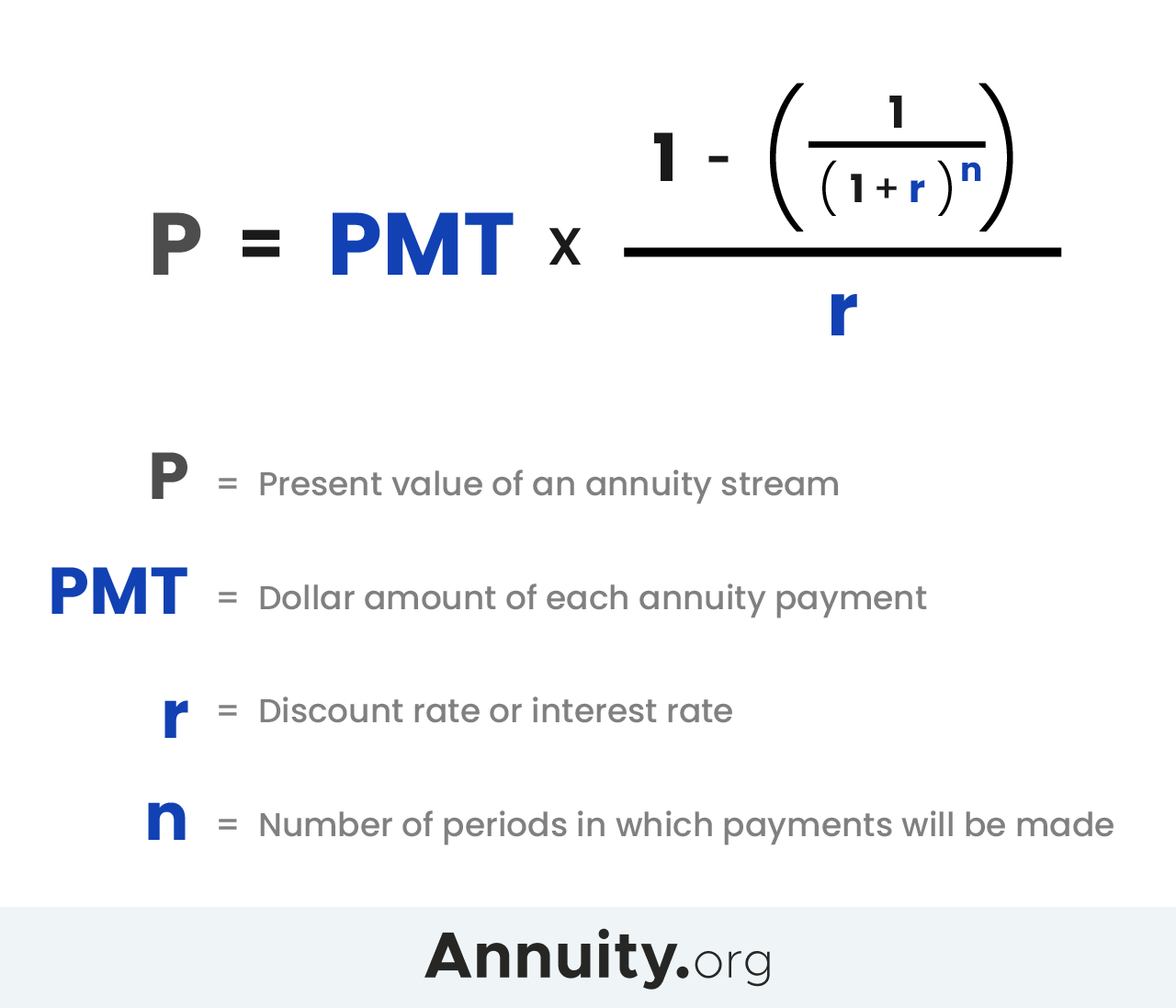

Calculating Present And Future Value Of Annuities

Present Value Of An Annuity How To Calculate Examples

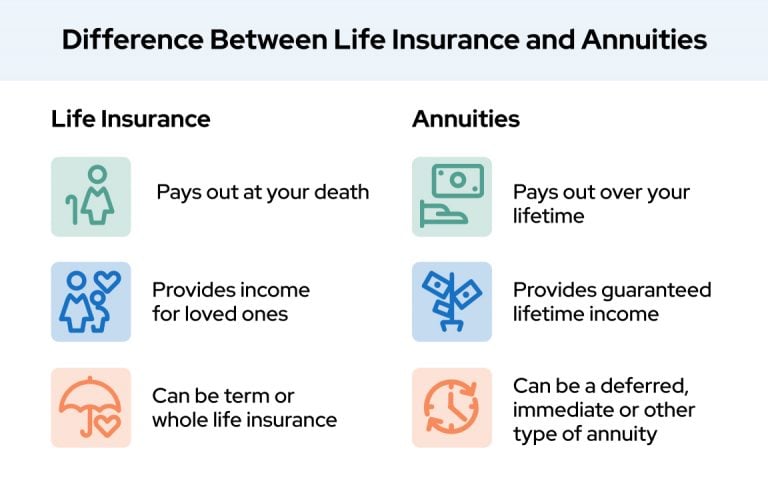

Life Insurance Vs Annuity How To Choose What S Right For You

No comments for "Which of These Annuities Require Premium Payments"

Post a Comment